New!

pensionForward - the essential pension, tax and benefits advice system

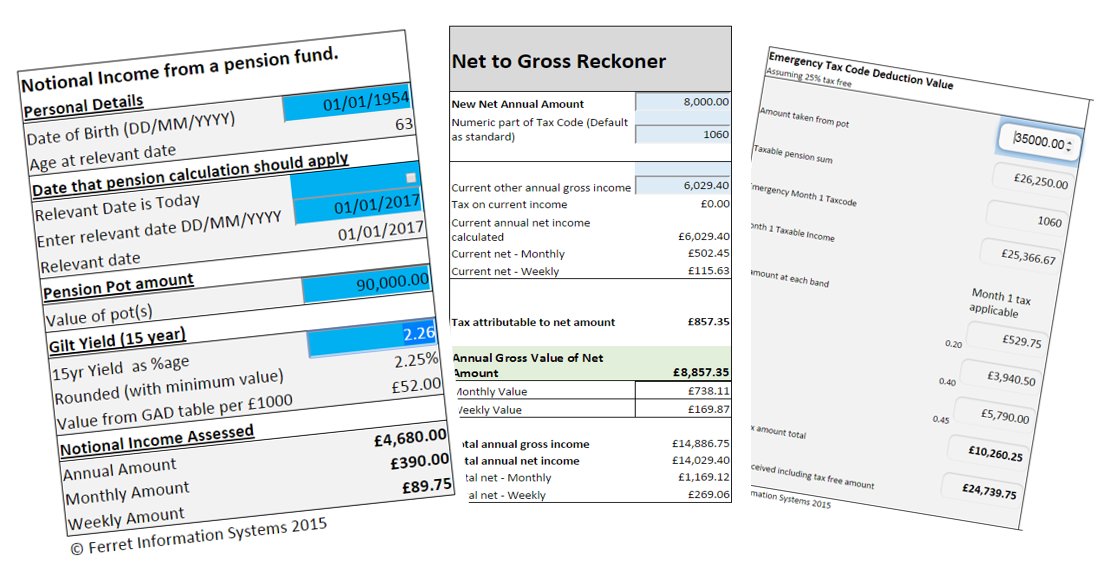

“What you take from your pot won’t be what ends up in your pocket.” While the new pension freedoms offer wider options to many people, understanding the effects of those options can be difficult; but vital. In a system where there can be a penny for penny reduction in benefits for additional income, or where a few pounds extra capital can mean a reduction in income of hundreds of pounds a month, making a mistake can be very costly for both client and adviser. pensionForward is the essential tool for those advising people under the new pensions freedoms. It combines comprehensive means tested benefits and tax assessments with detailed assessments of the impact of taking capital or income from pension schemes. Full graphical and tabular reports enable advisers and clients to immediately understand the impacts on overall income of their options for making use of their pension savings. It comes complete with specialist reckoners for assessing the effect of emergency tax applied to withdrawals, calculating the original gross value of income paid net and for determining the notional income value from pension savings. As part of the system, users receive, free, Ferret’s detailed e-learning courses on means tested benefits and on pensions, tax and the benefits issues, including the practical problems such as deprivation of income and capital and assumed notional income from pension pots.Information Needs

If they are to make the best choices from their options, clients will need to understand:- Their current tax and benefits situation

- The effect on their overall income of the options open to them – immediately and in the future

- The effect of taking different amounts of income and capital from their possible options

- What would be the effect now and in the future of planned or unexpected changes in circumstance

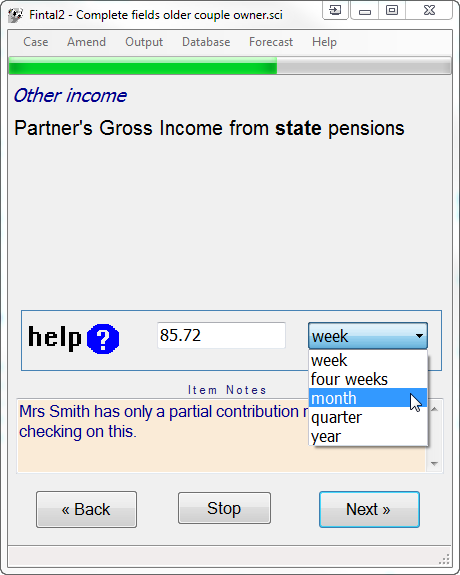

Income Entitlements Check

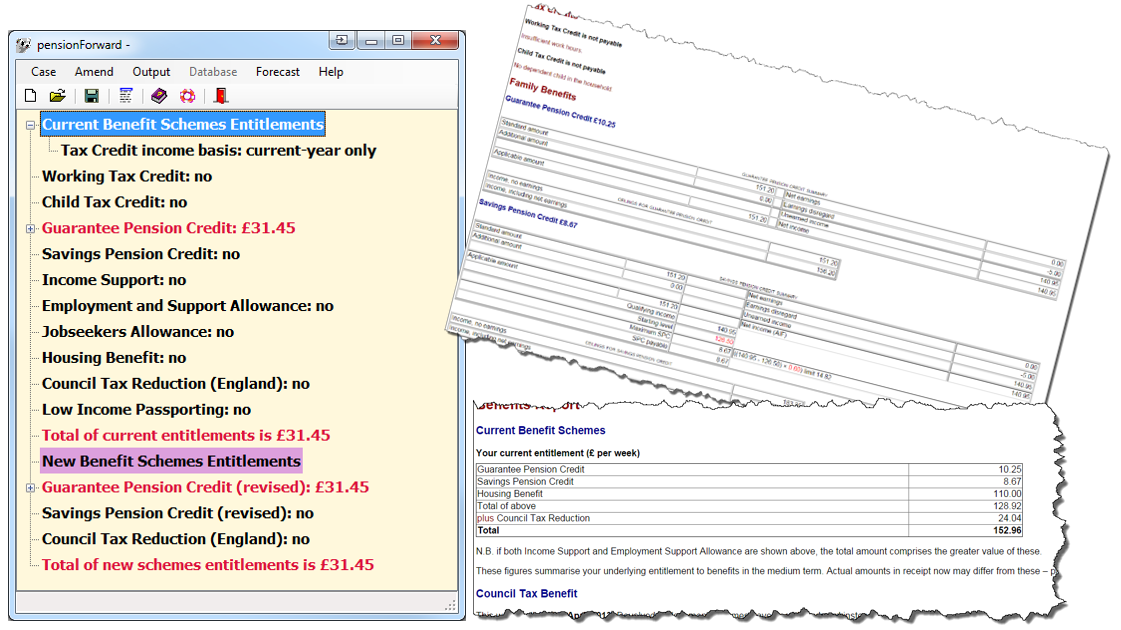

Government figures show that over a third of people entitled to Pension Credit don’t claim it (over 50% of home-owners) and around 45% don’t claim Council Tax Reduction. Making decisions without understanding what the current entitlement to support is, or what probable future support will be, can be extremely dangerous. Ensuring that people understand their entitlement to support allows them to be aware of the consequences on those entitlements of any reduction caused by their various pension options.The Effects of Alternative Options

“… the options relevant to that consumer should be discussed, alongside the key facts and consequences for each. While not exhaustive, the broad categories of options include:- Taking income via a formal retirement income product; for example, an annuity or drawdown product (including other income generating products that may emerge).

- Taking cash, which could be used for any purpose including providing ad hoc income or a rainy day fund.

- A combination of these options.

- Not taking any action at that time”

John is 58, single, a mortgage free homeowner and is unemployed. He has an average sized pension pot of £35,000.

He is entitled to £73.10 a week income-based Jobseekers Allowance.

He has been told that he could receive £140 a month net as an annuity.

This sum, £32.30 a week, reduces his benefit by the same amount to £40.80 a week.

His annuity does not increase his real income by even 1p.

John’s pension pot would not be taken into account as notional income for benefits until he reached the qualifying age for Pension Credit.

He could take capital from the pot with no effect on his benefit, as long as the total that he held, at any one time, was below £6,000.

If he took all his pot as capital in one lump, it would incur a tax hit of £3,130, after his 25% tax free allowance, leaving him with £31,870.

That amount would remove his entitlement to the benefit completely. If he took £16,000, that would after tax leave £15,720 – below the £16,000 cut off point for the benefit- but it would reduce his benefit by £39 to a level of £34.10 a week *

*All figures calculated by pensionForward.

The Details

- Simple to use

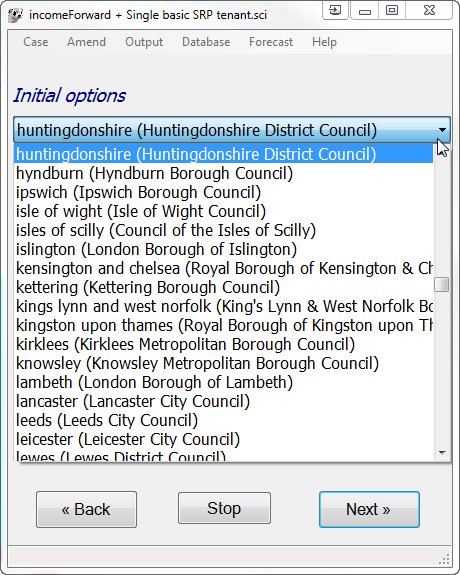

- Comprehensive means-tested benefit and tax credit assessments for those above and below pension age

|

|

Any important changes in the effect on the client are clearly flagged so that the user can focus on them.

The information from the table is also shown in graphical form, where the top line shows the overall level of income and the different income types which make it up are shown clearly.

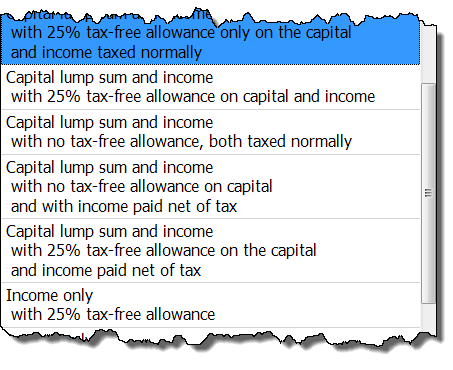

The output covers pension withdrawals of income, capital or both and is produced for cases above and below pension age.

Any important changes in the effect on the client are clearly flagged so that the user can focus on them.

The information from the table is also shown in graphical form, where the top line shows the overall level of income and the different income types which make it up are shown clearly.

The output covers pension withdrawals of income, capital or both and is produced for cases above and below pension age.

|

|

- Net amount of pension received after Emergency Tax Code applied

- Notional income from pension pot for benefits purposes

- Gross value of pensions paid net of tax

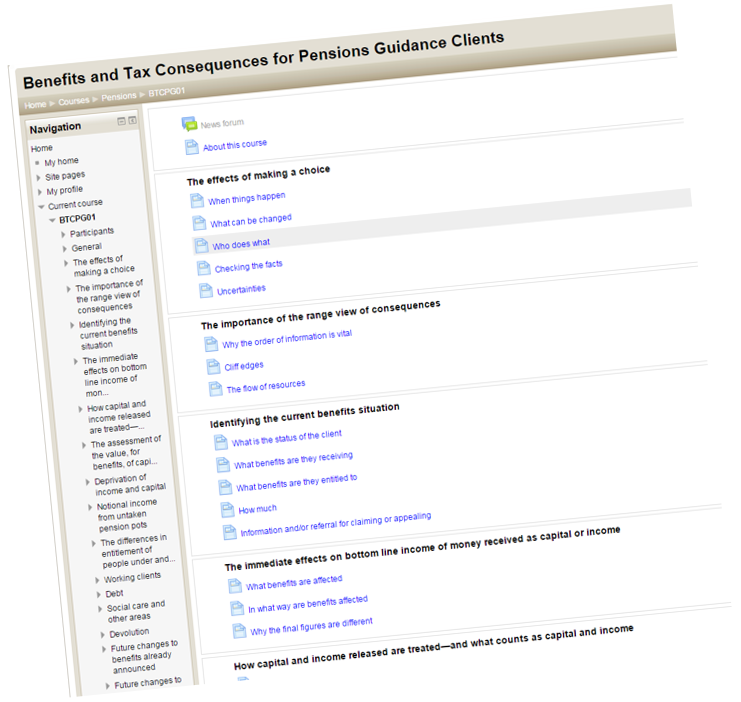

- eLearning course on pensions, tax and benefits

- eLearning course on means-tested benefits

- Helpline service

PensionForward

pensionForward is the essential tool for all those advising people about their options concerned with pensions. Benefits advisers, financial advisers, those working with older people and social landlords will find the system invaluable and inexpensive. The updating service ensures that it is always up-to-date and accurate. Evaluation copies are available, please email info@ferret.co.uk for more details.

4 Coopers Yard, Curran Road, Cardiff, CF10 5NB - Wales, UK

Office: 029 2064 3333 Customer Support: 029 2064 4444

Office: 029 2064 3333 Customer Support: 029 2064 4444