The Future Benefits Model

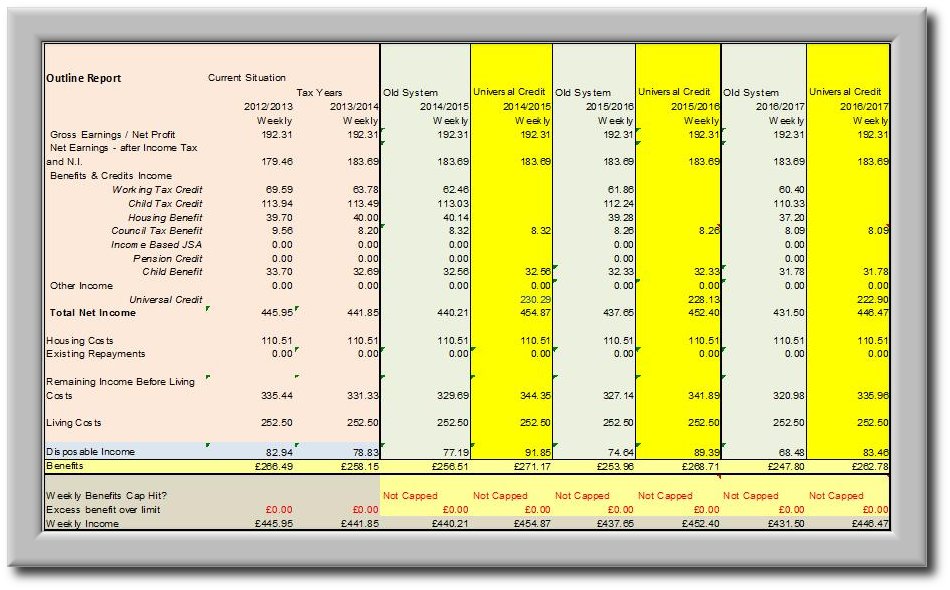

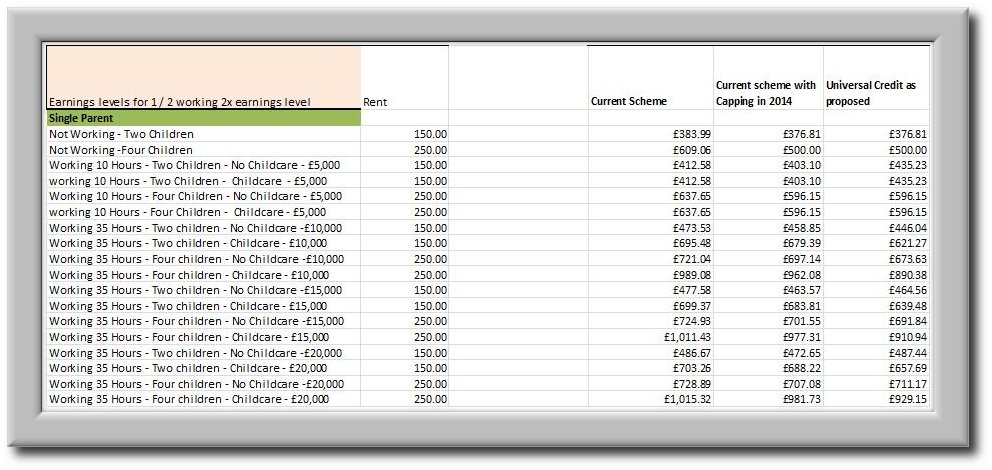

Ferret’s Future Benefits Model (FFBM) is a microsimulation model which produces year by year assessments for a large range of scenario circumstances over a rolling five year horizon. The future circumstances take account of the introduction of Universal Credit and other reforms to the welfare system allowing direct comparison of the same circumstances under different benefit schemes. The model has been widely used by researchers in academic and other bodies to assess the impact of welfare reforms on groups of people and to model the effects of changing rules or parameters from those in force or proposed. Recent work based on the model includes research for the Local Government Association, London Councils, Save the Children, Queen Mary’s College and several housing associations. The FFBM produces small or large sets of personal tax and benefits data which is able to be used for a number of purposes, including- Impact assessments of current and new benefit schemes in topics such as housing affordability or entering employment

- The effect of future changes in real values or tax and benefit rules

- Analysis of multiple case groups with varying parameters of family type, income and expenditure

- The effects of changing benefit or tax rules, rates or conditions.

The assessment period starts from the current benefit schemes rules and rates and incorporates future changes in appropriate years. The model produces comparisons of ‘old scheme’ and ‘future scheme’ assessments for each relevant year to allow for the parallel running of the schemes. This model consolidates the changes to personal tax and benefits rules announced in the Emergency Budget of June 2010, the Comprehensive Spending Review of October 2010, the Autumn Statement 2011, 2012 and 2013, the Budgets 2012 and 2013, and the Welfare Reform Act 2012 with subsequent regulations and guidance, together with other changes announced to the current schemes of benefits.

The model includes the effects of reductions in real values of benefits, caused by government changes to up-rating methods, and cuts and freezes of benefits and elements of benefits in the years in which they take effect; alternatively it may be configured to use headline values. The benefits and tax elements assessed within the model include,

The benefits and tax elements assessed within the model include,

- Universal Credit

- Income Support

- Income Based Job Seekers Allowance

- Income Related Employment and Support Allowance

- Working Tax Credit

- Child Tax Credit

- Guarantee Pension Credit

- Savings Pension Credit

- Housing Benefit

- Council Tax Reduction – Default, Scottish, Welsh and local schemes

- Child Benefit

- Personal Income Tax

- Class 1, Class 2 and Class 4 National Insurance contributions

- Class 1a Employers National Insurance contributions

- ‘mixed-age couples’ and age rule changes

- Transitional protection on migration to Universal Credit

- Changes to disability support within means-tested benefits

- Geographically based variables such as rents, income levels or Local Housing Allowance limits

- Expenses such as travel to work, childcare and other living costs

FFBM can produce a substantial amount of output data for immediate use or subsequent evaluation. The model is extremely configurable in input type and method, assessment rules and rates, and output structure and format.

A typical configuration may assess,

- Single people and couples with from 0 to 6 children

- Social tenants, private tenants and owners with different rent levels by appropriate property size, and different mortgage amounts by multiple percentages of property values.

- Not working, working part-time and working full-time with one and both members of a couple working

- Full-time work from £5,000 to £35,000 per annum

- Part-time work from £2,500 to £17,500 per annum

- Work at varying hourly rates, including minimum wage and living wage, from 6 hours a week to 42 hours a week in 6 hour bands

- Effects of childcare

- Effects of the under-occupation penalty – the ‘Bedroom Tax’

- For 8 different areas with different rent levels, income levels and other variations

4 Coopers Yard, Curran Road, Cardiff, CF10 5NB - Wales, UK

Office: 029 2064 3333 Customer Support: 029 2064 4444

Office: 029 2064 3333 Customer Support: 029 2064 4444