FerrCalc

The Quickest Benefits, Tax and Pension Credits Calculator Available

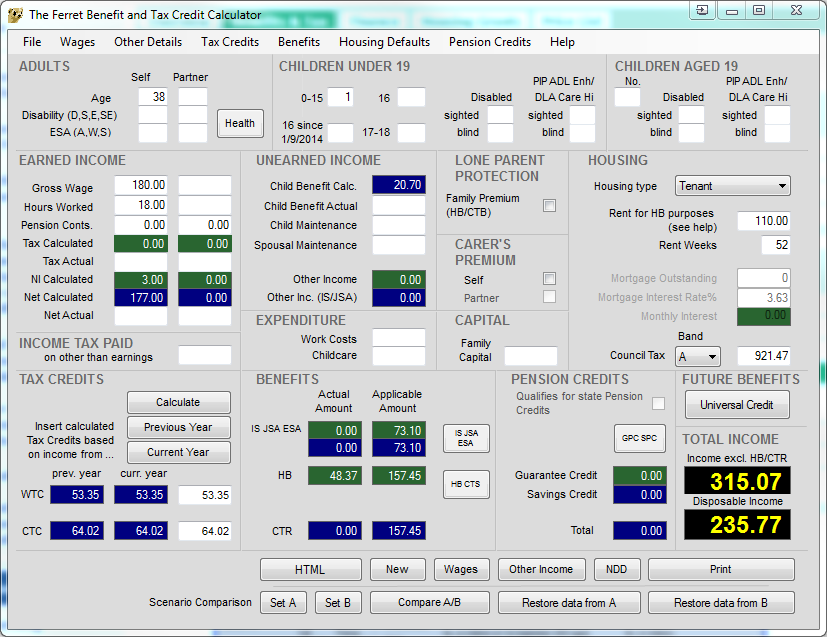

FERRCALC is a welfare benefits tax and pension credits calculation program most suitable for advisers with benefit knowledge, as it assumes the user has a good working knowledge of the benefits system. The calculator is based around a single main screen which enables you to enter data quickly and easily, to assess entitlement for means tested welfare benefits, and tax and pension credits.

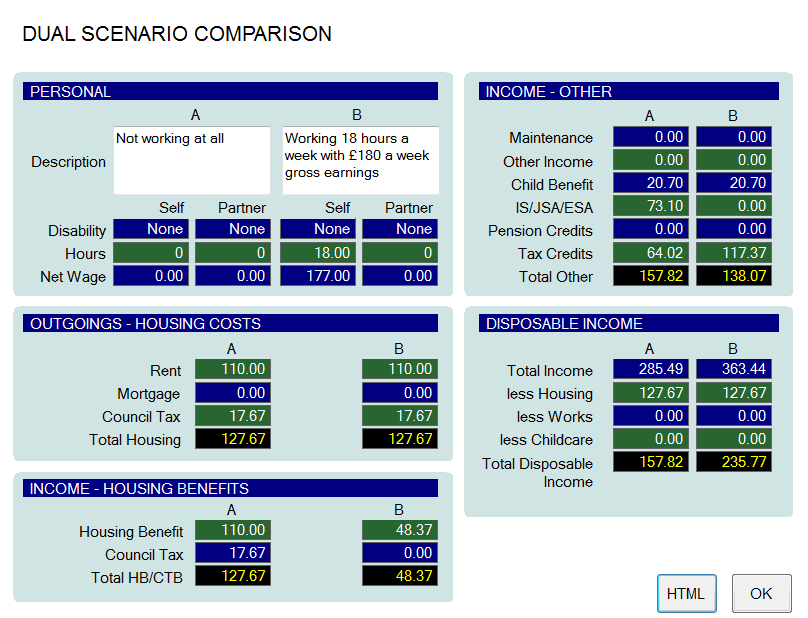

Better–off comparisons, which can be used for many changes of circumstance such as entering or leaving work, or changes in age are built-in. This uses a powerful scenario manager so that users can jump back and forward between two sets of circumstances, quickly amending them as they wish.

New scheme benefits including Universal Credit, Council Tax Reduction and the future Pensions Credit Plus scheme are included.

FERRCALC is easy to use - just enter the client's information into the appropriate boxes and the calculation will be instantly produced for you on the main screen. Ancillary screens are available for pension credits, other income and non-dependents and can be accessed for details of all calculations.

FerrCalc main screen

Features

- Enables the user to quickly, accurately and simply assess the claimant's probable entitlement to welfare benefits and tax and pension credits

- The system is always up to date and accurate

- Is easy to use and intuitive, and requires little training

- An easily accessible context sensitive help system provides detailed support

- Changes can easily be made to case input to examine "what if" situations

- Cases can be saved, loaded and quickly reviewed or amended

- The Tax Credit projection enables longer term advice based on the likely situation in future years and identifies any likely under or over payment of tax credits and their interaction with Housing Benefits assisting "all considered" advice giving

- Printed output is available from all screens

- Runs on all supported Windows based networks, desktops, laptops, notebooks and tablets

- Can be up and running virtually immediately

FERRCALC gives the user the facility to provide immediate and detailed advice; a best-practice service supported by Ferret's benefits advice and expertise, proven in practice for over 30 years.

FERRCALC is based on a single easy-to-use input screen, enabling the experienced benefits adviser to input information quickly in weekly, monthly or annual format and obtain the required information there and then. Ancillary screens provide more detail if required.

Details of the calculation of each benefit and of tax and National Insurance are available so that queries about differences in award or assessment can be easily identified.

|

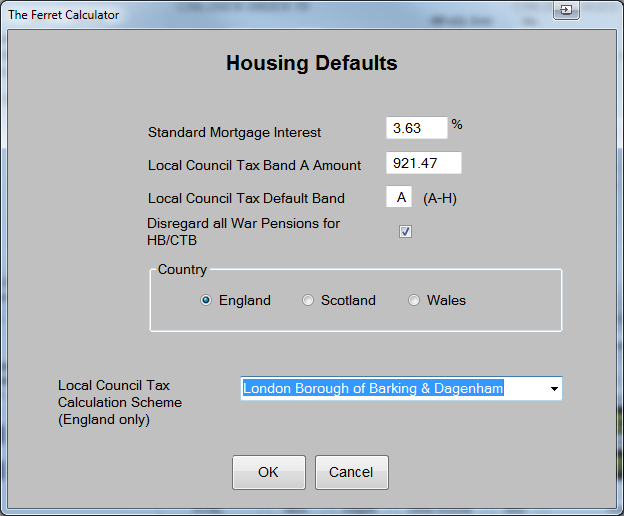

Local Council Tax Reduction schemes, for English local authorities and for Scotland and Wales are included and Ferrcalc can be configured with local default Council Tax values. |

FERRCALC'S questions are supported by context sensitive help - even the most experienced adviser can't always remember everything - and quick reference help is there at hand if required.

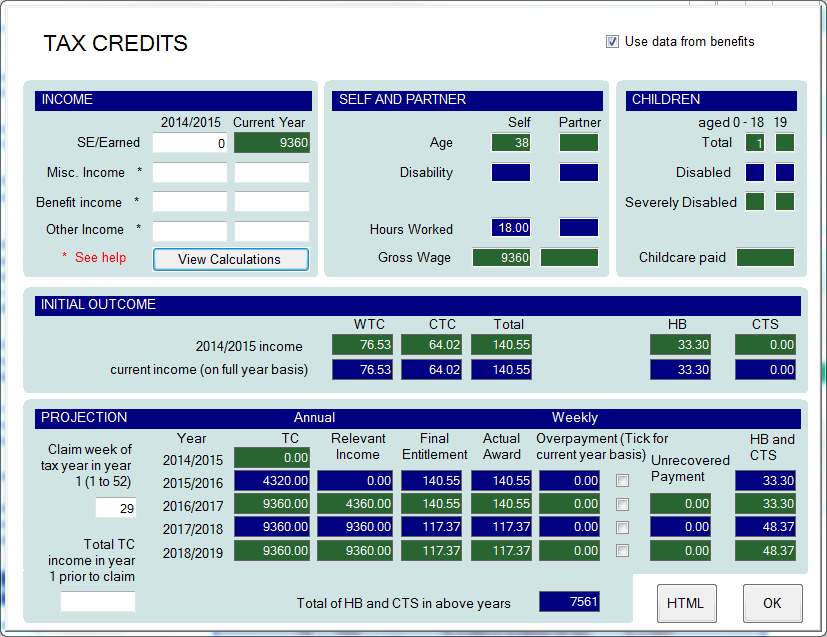

Tax Credits calculation and projection screen

FERRCALC'S tax credits module shows details of the calculation of Child Tax Credit and Working Tax Credit and produces a projection over the next 4 years highlighting any under or overpayment plus the impact these may have, and any interaction with, Housing Benefit. These can be adjusted for a part of a year and "zeroed" to show the impact of reassessment.

FERRCALC can produce a single output report for the case plus detailed reports of each of the support screens if needed. Cases can, of course be saved and reloaded.

FERRCALC'S straightforward entry system enables a quick and easy reassessment to be made for a change of circumstance or "what if" calculations and the results printed out for comparison.

FERRCALC is available in both stand-alone and network versions. Discounts available for more than one copy.

FERRCALC evaluation programs are available free of charge, just call Ferret on 029 2064 3333.

Office: 029 2064 3333 Customer Support: 029 2064 4444