Fintal 2

It makes use of the latest technologies and extends the original capabilities of the industry-leading Fintal program.

Designed to cope with the latest changes to the financial system, Fintal 2 is even easier to use and more powerful.

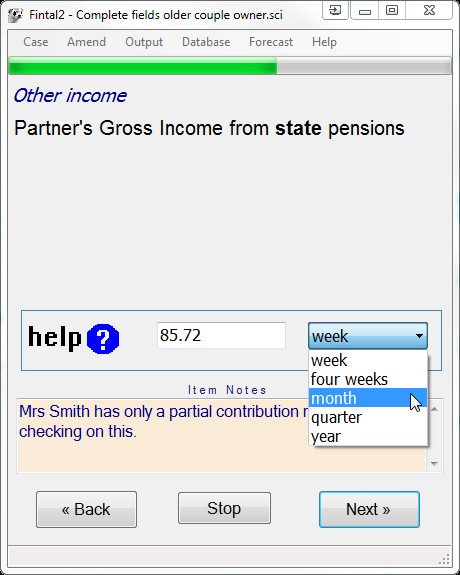

FINTAL dialogue screen

FINTAL dialogue screen

Benefits

- Enables accurate, on the spot calculation and advice, saving delays in decision making process

- Helps to build trust between adviser and client

- Provides an audit trail for compliance

- Clear and comprehensive graphical representations to demonstrate "what if" situations, projections, and the relationship between Income and Capital

- Structured dialogue ensures capture of all relevant information

- Context sensitive help and information system for support

- Kept up to date and accurate by an updating service as part of the annual contract

- Deployable on desktop PC's, laptop's, and networks

- Advanced tax and notional income calculations

- Supported by telephone Helpline which includes benefits advice as well as technical issues

| Compare competitors and Fintal 2 | ||

|---|---|---|

| Fintal2 | Competitors | |

| Working Age Benefits |  | X |

| Tax Credits |  | X |

| Older peoples benefits |  |  |

| Local Council Tax Reduction |  | X |

| Universal Credit |  | X |

| Mixed Age Couples |  | X |

| Full calculation details |  | X |

| Tables of ranges of capital received |  | X |

| Chart of ranges of capital received |  | X |

| Tables of ranges of income received |  | X |

| Chart of ranges of income received |  | X |

| Tax calculations of income |  | X |

| Non dependents impact |  | X |

| Full benefits assessment capability for other cases |  | X |

| Calculates notional pension income |  | X |

| Calculates emergency tax |  | X |

| Calculates gross pension from net received |  | X |

Part of FINTAL 2 benefits results screen

FINTAL 2 can save cases for review over the period of the mortgage pre-sales engagement, allowing a review of information already considered and printed copy can be provided for the client to support recommendations. Information can easily be extracted from program output for inclusion in correspondence. After the sale is concluded saved cases and hard copy can serve as long term evidence of financial adviser compliance with the legislation.

FINTAL 2 is backed by the renowned Ferret helpline service that is not just there for system support, but also to answer queries around the administration and basis of benefits and the law behind them. Ferret's constant monitoring of the law and precedent ensures that, at a time of change, the system will always be accurate and up to date.

Part of FINTAL 2 benefits results screen

FINTAL 2 can save cases for review over the period of the mortgage pre-sales engagement, allowing a review of information already considered and printed copy can be provided for the client to support recommendations. Information can easily be extracted from program output for inclusion in correspondence. After the sale is concluded saved cases and hard copy can serve as long term evidence of financial adviser compliance with the legislation.

FINTAL 2 is backed by the renowned Ferret helpline service that is not just there for system support, but also to answer queries around the administration and basis of benefits and the law behind them. Ferret's constant monitoring of the law and precedent ensures that, at a time of change, the system will always be accurate and up to date.

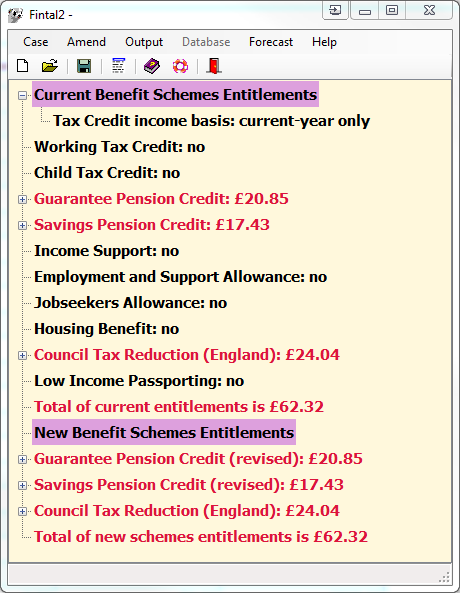

FINTAL 2 chart showing effect of increasing capital

FINTAL 2 has been produced in consultation with equity release and lifetime mortgage experts. It is backed by the Council of Mortgage Lenders and assists in conformance with their good practice notes.

FINTAL 2 chart showing effect of increasing capital

FINTAL 2 has been produced in consultation with equity release and lifetime mortgage experts. It is backed by the Council of Mortgage Lenders and assists in conformance with their good practice notes.

FINTAL 2 table showing the effect of increasing income

FINTAL 2 meets all the requirements of the Financial Conduct Authority (FCA) legislation. It ensures the clients benefit income is maximised, enables the financial adviser to present the client with options for consideration, and can provide long term evidence that all the relevant factors were considered and the best possible advice was given to the client at the time

FINTAL 2 table showing the effect of increasing income

FINTAL 2 meets all the requirements of the Financial Conduct Authority (FCA) legislation. It ensures the clients benefit income is maximised, enables the financial adviser to present the client with options for consideration, and can provide long term evidence that all the relevant factors were considered and the best possible advice was given to the client at the time

4 Coopers Yard, Curran Road, Cardiff, CF10 5NB - Wales, UK

Office: 029 2064 3333 Customer Support: 029 2064 4444

Office: 029 2064 3333 Customer Support: 029 2064 4444